Fine, actually? 🌞🌱 🎈

No landing, trad econ on ESG, health of the nation, T+1, listening and EMH

Well hi there folks! 👋

It’s been a fortnight - we had exactly 4 unidentified balloons in US airspace, about 566 trillion yen on the BoJ balance sheet and just one new coffee flavour over at Starbucks: Olive oil. Hard pass?

We spoke to Jason Hsu on the podcast on all things China. Are western investors biased when looking at China? Grab a coffee and give it a listen & decide for yourself (web | apple).

It’s also been a year since the start of the Russian invasion of Ukraine and subsequent war. It’s a grim milestone of course and you can’t even start to grasp the amount of human misery and suffering. Axios have done a quick recap (link) of the high level moments. One takeaway is surprises. Some bad (that Russia actually invaded), many good (Ukraine’s ability to resist, the West’s resolve to support, Europe’s ability to switch energy supply and possibly even avoid recession, but the huge cost of that).

At home 4-month old Sacha is starting sleep training. So that’s plenty of frustrated tears and screaming (sometimes he cries too). All in I think it’s probably going as well as could be expected. My toxic trait is that I can mostly sleep through almost anything so most mornings I have to kind of seepishly ask Mrs M how we got on during the night. As others in similar situations may be aware this can be a delicate matter and is generally not a question that you want to have to actually ask at these times. I’m pushing the boundaries of “there’s no stupid questions… “

With no big big new news, market participants mostly speculated idly about future Fed policy direction. Market participants like speculating idly. The data that did come out largely suggested that things are … well, like, fine?

That’s a surprise because well most folks thought that the economy would be in worse shape than it is for a moment there but things, honestly, kinda still seem fine. People keep spending, rates are probably nearing the peak and markets keep looking past inflation. There aren't many signs of recession in data. Kristina Hooper (link) wonders whether recency bias is an unnecessary cause of investor pessimism at this time.

Goldman Sachs who were always an outlier on the no-recession camp have cut their odds down to 25% of a US recession the year.

Earnings season has finished, it was kind of fine. Management played the game of slightly beating lowered expectations, so there were no nasty surprises. Earnings were down, about 5% comparing Q4 22 with Q4 21, while revenue was up 5%. Forecasts are another couple quarters of earnings falls then growth in H2 2023.

NEW LANDING SCENARIO JUST DROPPED! Take a seat and let me introduce you to the no-landing landing. Yes, it’s a thing and no I’m not joking. didn’t see that coming did you. If you think that sounds like forecasters shifting the goalposts as things change you’d be right, and I think the main takeaway is things like “hard landing / soft landing” are really just cliches aren’t they, not real analysis. And by the time the next smart cliche is invented it is probably already priced in.

Kyla Scanlon is here for us with the summary of what it all actually means:

I have questions. In a no landing landing where does the dead cat bounce?

Whisper it - there was even some rare positive UK econ data with lower public borrowing and higher tax receipts coming in than expected in Jan.

Markets

Stocks were kinda sideays there for a while but slipped a bit last few days, still up for the year (+5-6%).

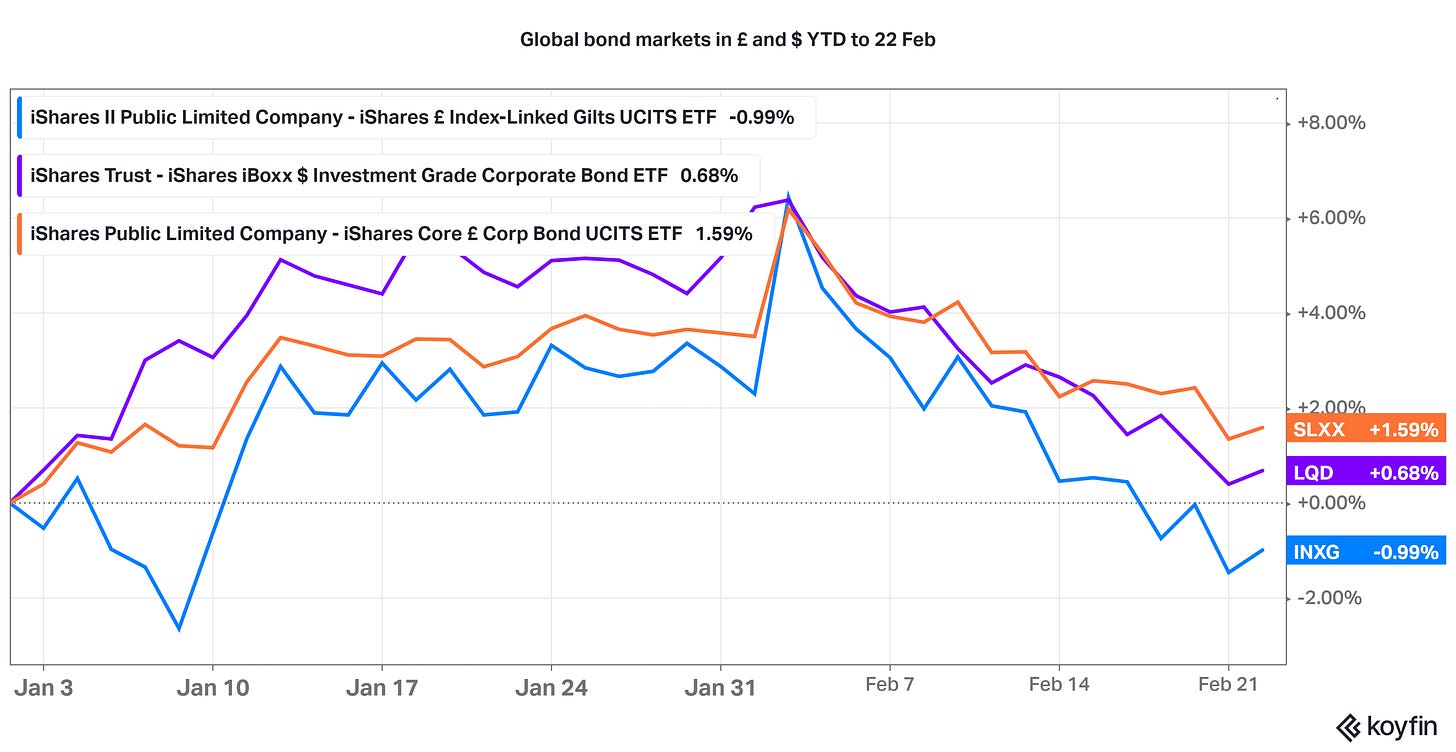

Bonds have done a u-turn, reversing pretty much all of Jan’s gains as long-term interest rates have edged back higher from the market’s peak-pivot phase in late Jan. 10-year rates are up 40-50bps but it only takes them back to roughly where they started the year so no biggie. Are stocks even maybe starting to live with higher rates?

3 things I’m reading

Professor Alex Edmans is out with a big new ESG piece “Applying Economics, not gut feel to ESG”. (link)

I’ve been meaning to dig into this one for a while, so here we go -

The bottom line: yes, ESG asks questions that requires new techniques and models, exposing limitations in existing ones. BUT, that doesn’t mean that traditional macro-econ models are all useless. Don’t throw the baby out with the bathwater. Traditional thinking models can help get at key issues and lead to important conclusions.

I do slightly push back on the idea that “gut feel” is a problem running riot in ESG, I think that’s a strawman critique, the bigger problem is conclusions being claimed on flimsy evidence, and accepted uncritically (which Prof Edmans has also written on) … but that’s a minor quibble.

Lots to like and plenty to think about here. Professor Edmans lists ten key takeaways, here are the three that I found most different to existing common thinking-

Sustainability Risks Increase the Cost of Capital (No, sustainability risks lower expected cash flows).

Professor Edmans challenges the “sustainability-risks-increase-cost-of-capital-and-future-returns” narrative in a way I hadn’t heard before - that financial theory says the cost of capital does not relate to stock-specific factors but market risk. So only if the risks act in the same direction at the same time as market risk should this get reflected in cost of capital. More likely these risks would reduce cashflows and hence returns.

Note Edmans also goes on to push back on the idea that sustainable stocks earn higher returns: sustainability could well be priced in. This is exactly the right point. I think the extent to which climate or other ESG risks are priced in is the question that needs far, far more thought on an ongoing basis, and across sectors. I can see arguments that it has been priced, or more than priced at certain times in say oil & gas, electric cars and tobacco stocks, but I also push back on what I see as “lazy” efficient market maximalism that assumes it is priced across all times and places. No investment factor “works” all the time and factors are changing baskets of stocks, in this sense sustainbility ought maybe to be no different.

A Company’s ESG Metrics Capture Its Impact on Society (No, partial equilibrium differs from general equilibrium).

The partial equilibrium vs general equilibrium model is a great way to understand the weird dynamic involved where you try and “pimp” your own emissions (or other) data for some report. You might well succeed in looking good but do nothing for the overall situation as you punt the bad stuff onto someone else. This is at least partly why portfolio emissions reduction targets and other such data are a bad thing to focus on and disclosure only gets you so far.

Shareholder Primacy Leads to an Exclusive Focus on Shareholder Value (No, shareholders have objectives other than shareholder value)

Professor Edmans seems fairly comfortable with the idea that shareholders can and do have objectives other than shareholder value which in itself is an important point. Far too much positioning in the industry has framed that as somehow impossible, illogical or not permissible. Shareholder welfare is a thing, so you don’t even have to go beyond selfish interest.

We’re just about starting to see more mainstream acceptance of this idea, with concepts such as the “fiduciary window” shifting to incorporate an understanding of broader welfare.

Bottom line: shareholder primacy isn’t the problem you think it is. Doesn’t mean it’s easy to define or decide how to focus on these issues, and good luck communicating to your asset managers, helping them aggregate across shareholders and face into trade-offs, but we can move past this latent uncomfortablenss with having other objectives. So I guess the insight here is you don’t need to even move past shareholder primacy to allow other objectives into the equation.

Externalities has been one key route to me understanding ESG better and this is another way highlighted by Edmans that it actually fits into standard economic thinking.

It’s another super paper chock full of crystal clear thinking well worth reading through, you’ll be smarter and a better thinker for it.

The Great Retirement or the Great Sickness? Understanding the rise in economic inactivity (link)

It’s health, actually. This piece by LCP colleagues is too good not to share. Using public data they dismantle the idea that “The Great Retirement” is repsonsible for the recent fall in the UK active workforce - the driver is long term sickness.

More important evidence that there's an economic view of health policy that frames it not as a cost, but as an asset, an investment in social & economic prosperity.

This seems to matter as these issues look likely to define the next election cycle and more. It’s a big deal as we all start to debate how best to explain and reverse this relative economic malaise we’ve experienced over the last 15 years.

T+1 Settlement cycle (link)

I know this potentially sounds almost too boring for words but can we take a moment to appreciate what a good thing this is for investors? Halving the time it takes to actually get your hands on your money. Not before time mind you in 2023 (I feel like the blockchain fixes this). And while we’re here a shoutout to all those managers still requiring wet-ink signatures faxed via Switzerland, the Metaverse and Hogwarts to move money. In 2023. I feel like the blockchain fixes this.

Two things I’m listening to

Shane Parrish is talking about being a better listener with coach Carolyn Coughlin (web | apple)

The Rest is Politics (web | apple) is a new podcast on my rota and is really delivering the goods so far. Alastair Campbell and Rory Stewart with some refreshing straight talking and genuine push-pull debate on the big issues of the moment, quite the team.

Grab bag

Can we talk about Gen-Z?

Just three recent surveys have them as variously quitting over climate concerns, the most stressed generation ever, and likely to leave unfulfilling and purpose-light jobs (or maybe all 3?) . One thing’s for sure, it seems like they are the most speculated-about generation. Some of that’s the usual generational snark, for sure, but I think a decent amount comes from a good place as senior folks in firms do want to try and understand the drivers of what seems like to them a different culture.

The largest study on the 4 day work week has finished up, right here in the UK. And it seems to have been …. positive? [Sky]

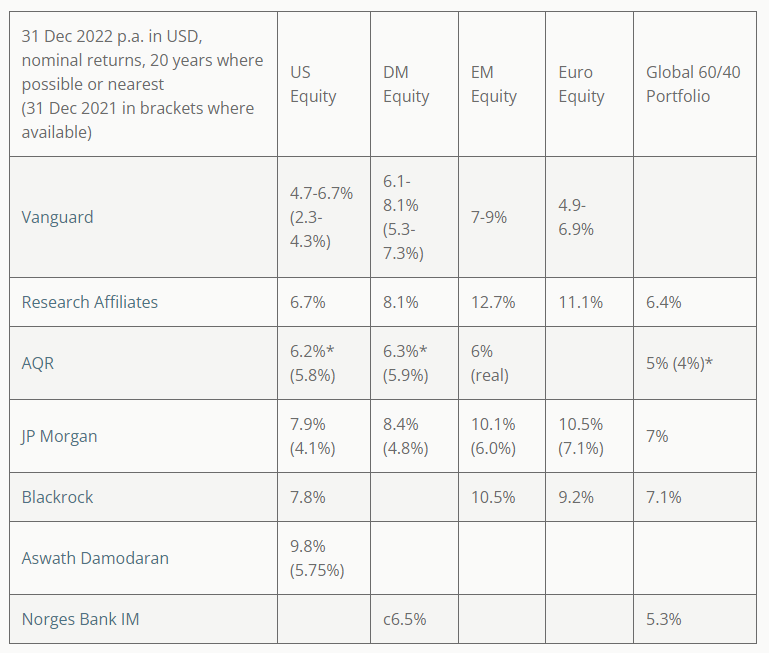

And I wrote a big thing on expected returns (tl; dr take them seriously, not literally).

Cliff Asness was talking to the Economist. On how he’s become less of a believer in efficient markets over time: “I used to be 75% Fama 25% Thaler, now it’s 75% Thaler 25% Fama”. What’s the world coming to when Gene Fama’s PHD student is leaning away from efficient markets! (web)

Another big weekend on the way in the 6 Nations. Congrats to the Irish, looking like a hell of a team. Wales / England now finally going ahead but looking a little like a bottom of the table clash. Scotland are going to find out if they can join the top tier. Enjoy!