Of snow dumps & data dumps ❄️⛄️📈

Peak inflation, peak rates, peak Messi, peak Mariah ...

Hi everyone and especially bonjour to all my French readers(I know who you are as you all kindly messaged to comment when I put the accent in the wrong place on la rentrée 🤣 Allez!)

This week's snow has provided some welcome light relief in our household following a weekend in A&E / hospital with a feverish and rashy 8-week old Sacha (I hear there was a football game on the saturday night, don't tell me the score, catching up later) anyway all ended ok but I can tell you the children's A&E reception is just not somewhere you want to be right now (although in terms of care, NHS did a fantastic job, as ever). Anyway round our way the snow has really stuck around nicely so as I write on Thursday morning there’s a lovely alpine kind of energy, and the chunky knits are out. Tell me that getting a coat on an unwilling toddler isn’t one of the toughest test of wills / persuasion challenges out there though!

Word of the year: Goblin mode is a neologism for the rejection of societal expectations and the act of living in an unkempt, hedonistic manner without concern for one’s self-image. Lovely. I won’t be sharing that concept with the kids anytime soon.

Some combinations are as natural as they are timeless: Yin & yan, simon & garfunkel, Ant n Dec, gin n tonic, inflation and interest rate rises. That last pairing has certainly told you pretty much all you need to know about 2022 but …

Is the peak in?

It’s a good day to be putting out a newsletter as this week has seen a BIG dump of macroeconomic data & announcecments which more or less completes the picture for where the global economy is at the end of this wild topsy-turvy year. What to make of it all?

If the theme of 2022 was tracking inflation and interest rate surprises higher and further (so many hikes you’ll need new walking boots), then 2023 looks like it might be the reverse. This week’s mega data dump gave strength to the argument that inflation has peaked: in the US where it fell for a second month in a row, and in the UK where it fell for the first time, and by slightly more than expected. Still WAY above target, mind (10.7% vs 2%). Although the “maths” of looking at year on year numbers pretty much ensures these will continue falling as old high months roll off and newer monthly readings were quite a lot lower than expected (eg just 0.1% month on month in the US).

And so interest rates probably aren't that far off peaking either - the Fed, Bank of England and the ECB all raised rates by 0.5% as expected: markets looked to the statements for future indications, with the Fed’s statement and famous dot-plot indicating a higher peak of rates (~5%) than what is expected, and the ECB also guiding toward a higher peak, but the BoE split vote indicating more appetite for no increase than expected.

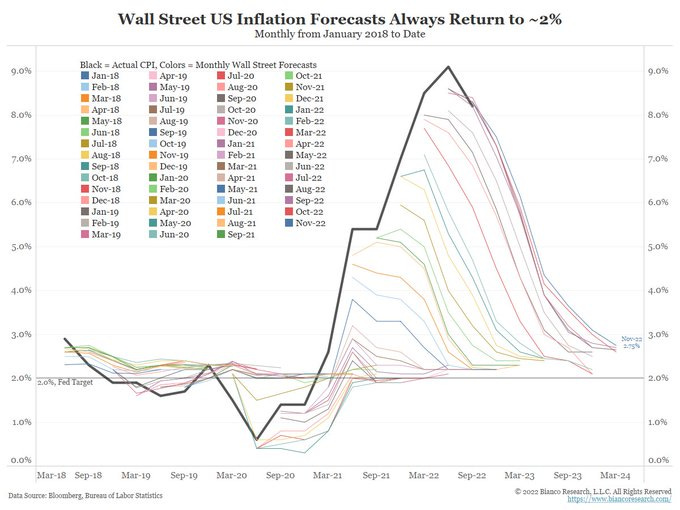

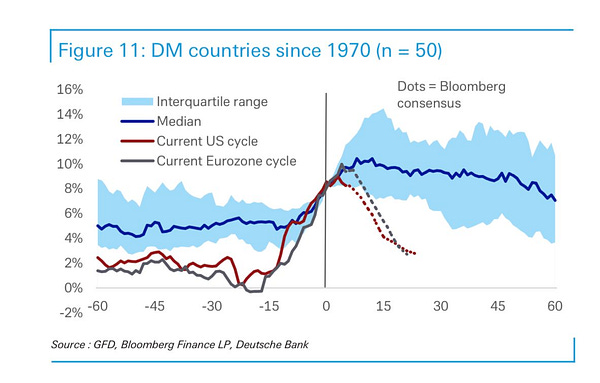

The market expects both inflation & rates to be well into falling by the middle of 2023, although the market really hasn't been a great guide to such things it should be noted, and historical data is not on side with a rapid fall in inflation either. We need to talk about some of those big biases that economists seem to have around always thinking inflation is coming down (cue chart of 2022: The Medusa. source: Bianco Research)

that, and earnings, as market watchers move on to obsess about 2023 corporate earnings, it still looks as though estimates are too high despite a series of revisions lower in 2022.

If Transitory was infamously the word of 2021, Uncertain lags and soft landings has become some of the most widely used phrases of the second half of this year.

The vibe has shifted from “inflation is out of control and they are hiking rates like mad” to “things are returning back to earth (but how fast and how hard matters)”.

As we turn the page on the year the Economist’s cover this week on: The New Rules of Investment (link) seems apt - higher interest rates and inflation affect different assets differently and that matters for investors. It’s become a cliche to constantly say how much things have changed, but objectively they really have in 2022 and the turn of the year is as good a point as any to take stock on what it means. Howard Marks thinks it is the third big “sea change” he’s seen.

Markets

Nothingburger. Reactions to this week’s stuff was not much really suggesting they had already been well priced in the “glass half full” vibe of the last couple months. And that goes to show why you shouldn’t base your investing strategy on macro calls. Markets bottom on peak-pessimism, which doesn’t get reported in data.

One point to note was UK gilt yields drifting slightly higher as global yields went in the opposite direction. For bonds it looks pretty set that we’re about to turn the page on one of the worst years on record for bond performance (-15% for corp bonds -20-35% for gilts) - but on the flipside good yields offer better returns ahead.

Global stock markets are also turning the page on a bad year (~-15%), although with a big surge in Q4 not as bad as the 25%+ bear market we were looking at one stage, also unhedged sterling based investors have seen a lot of offset from £ (only -7%). Techy stuff is down more than broad market, and hasn’t seen the same bounce in the last month EM isn’t looking so bad (-19%) after a monster rally from China last couple weeks and the UK is one of few markets in the black thanks to energy and mining stocks.

3 Things I’m reading

How Accurate are Capital Market Assumptions? [Mike Sebastian - research paper link]

Shoutout to John Belgrove who pointed me to this excellent paper.

The bottom line: This paper does what no-one does, but everyone should, which is to look BACK at expected returns and ask the simple question: were they good forecasts?

No, is the simple answer. Forget quoting expected returns to two decimal places or even one decimal place, you should probably be putting +/- 3% ranges around them all (yes, even bonds). And the spread from different forecasters can also be highly misleading, this gives a false sense of precision as well - the outcome over the last decade was outside the range of all forecasters in almost all cases.

Come for the returns, stay for the allocations. There’s more to expected returns than just getting the numbers “right” though, your numbers might be flakier than a Neymar dive in the penalty box, but as long as asset classes are right relative to each other you’ll make broadly the “right” allocation decisions off the back of it.

Why it matters. Expected returns do a huge amount of work. I'm often torn between thinking that expected returns don't get enough focus (relative to the generic "market go up/down" type commentary) but also thinking that they carry far too much weight in allocting capital given that they are little more than "made up numbers". Tens or even hundreds of billions in capital flows can be directed at the flick of a spreadsheet adding an arbitrary amount to a made up number. For example by assuming that private assets carry a greater return, as many do.

The bottom line. Prediction is difficult, especially about the future. A little humility wouldn’t go amiss in expected returns, and time spent sweating every last 0.1% could maybe be better spent elsewhere. A lot of the issue here goes to the fact that the world is just uncertain, yet so much of the “industry” is built up around trying to give a (false) sense of security.

PE-Kaboo - The Economist on Private markets valuations. This piece was good, and seems to have drawn a lot of shares / comments [link]

I think it’s good that more investors are openly questioning the “illusion” of private market valuations, at times like this the disconnect between private and public market valuations is very stark (often for very similar types of assets: hello infrastructure), and perhaps reveals the true value of private markets in the “returns smoothing service” they provide (completely opposite to the “illiquidity premium” idea).

Yes, but. Maybe there is a parrallel illusion that public markets are perfect judges of valuation - they aren’t. Maybe the right answer is just somewhere in between.

Schroders Credit Lens - December 2022. [link]

Top-line: important insight into credit markets which is where some of the best investment opportunities are right now. The sentence: “The market could go up or down but bonds yield good” could have passed for many a 2023 market outlook.

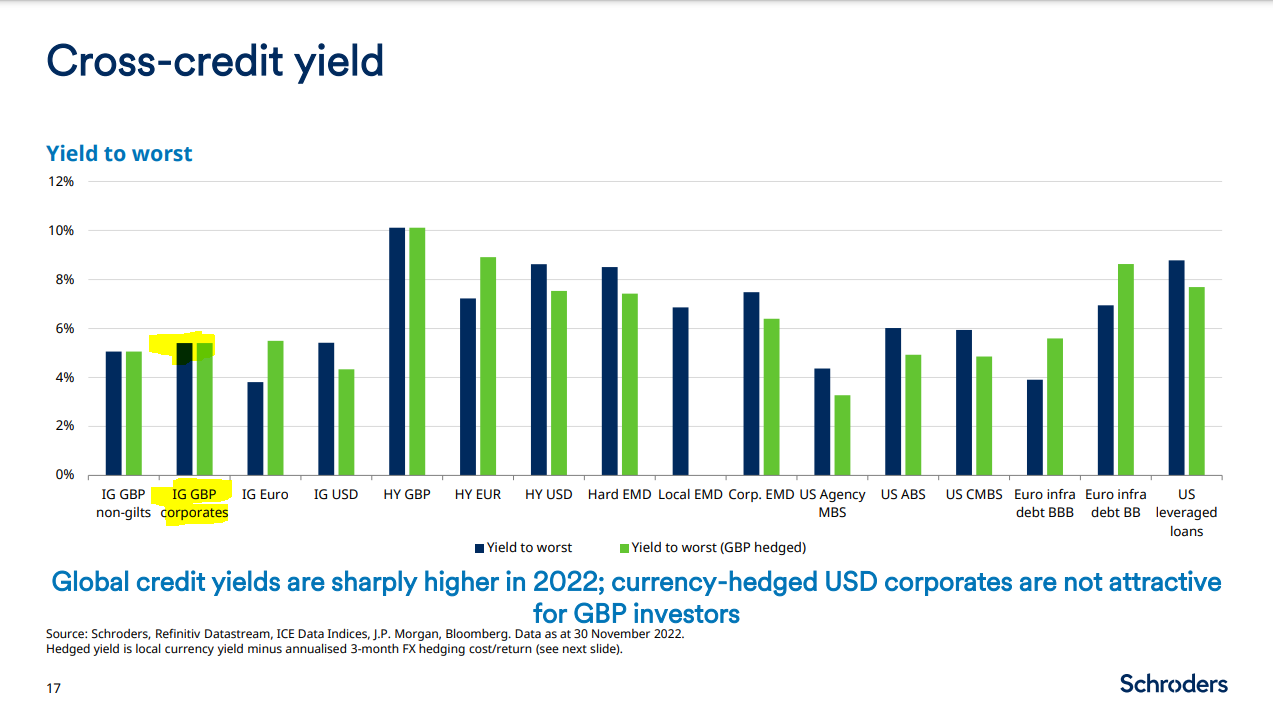

Corporate bonds look good investments, but a little less good than in recent months. UK investment grade bonds are the place to go and at the shorter dated end (and hedging costs are making overseas bonds trickier to hold).

There are some worries about default rates rising, but it’s from a low level and corporate fundamentals generally don’t suggest an impending credit crisis. Only seems to be the very worst quality CCC bonds getting hit hard.

Podcasts

There’s a lot to like in this conversation: How the FCA is thinking about moving early on sustainble fund regulation, without waiting for perfect taxonomies, enforcement vs regulation, the sound of harmonisation with global regulators particularly Europe and SFDR which the FCA is building on (good!). And aligning with existing standards and ratings (hello ISSB). Reconciling US-style financial materiality with more European style double materiality, how words matter (improver vs transition) and leaving funds free to not aspire to sustainable impact but make sure they can’t then half claim it.

Stocking fillers

Fund investing hits different and it needed a book (our latest podcast with Joe Wiggins). A must listen if you work in the funds industry (web | apple). Those of you who listen to the podcast will know that I'm going to be without co-host Mary for the next little while (she's off on a wonderful trip to central and southern america - have a great time Mary!) and I'm looking forward to being joined by a couple of other colleagues as guest hosts while Mary's gone.

A few book ideas for anyone in need of inspiration as we get close to christmas, here’s the last 5 books recommended by guests on the podcast:

The Body Keeps the Score: Brain, Mind, and Body in the Healing of Trauma (recommended by Joe Wiggins)

The legendary cricket genius Sydney F. Barnes (Chris Martin)

The Money Minders: The Parables, Trade-offs and Lags of Central Banking: Jagjit Chadha (Karen Ward)

A Gentleman in Moscow: Amor Towles (Karen Ward)

The Big Short (film & book) – Check out our book club episode (James Baldwin)

And a few that are on my xmas reading list: Money Men (Dan Mccrum), Slouching Toward Utopia (Brad DeLong), and 4,000 Weeks (Oliver Burkeman).

ChatGPT: - that thing everyone's talking about. It's an AI-engine that writes stuff on demand ("natural language" in the jargon), but better. It's got a lot of folks very excited and some of the text certainly reads impressive, seems to be able to pen a pretty plausible oped although on a second pass it can be a bit superficial and limited. Even the company's CEO says that a problem lies in it being "confident and wrong" far too often (sounds like a few other folks I know tbh ... ).

Azeem Azar (link) worries about the potential for broken trust in a society that isn’t yet “ready” for large scale costless production of written word (think university professors grading essays as just one example). It could overwhem our judgement filters. The Economist (link) sounds a slightly more sceptical tone - is it just regurgitating a pastiche of googlable info with buzzwords thrown in - although I bet it could do a very compelling job of a standard market outlook.

It seems a fairly safe bet that AI will be important over the very long term but I think folks have rightly gotten skeptical of firms coming up with things that are little more than “parlour tricks” to generate viral buzz (is this in that camp? Not sure). They say “it will only get better and better”, and I’m sure that’s true, but we also said that about voice assistants 7 years ago and they are still only timing eggs, playing music and telling the weather for many people.

It’s been almost a year of these mumblings, I might do one more wrapup type thing before the year’s out, but thank you for following along and taking the time out to choose to read this one out of all the newsletters I’m sure you get. I really do appreciate it.

Have a great Christmas break whatever you’re up to.